Speaking at the University of Chicago’s Harris School of Public Policy Studies, across the street from where Obama once lectured at the law school, Pawlenty contended his proposals – combining lower tax rates with an emergency freeze on spending – would be a “better deal” than what the Obama administration was offering.

“How are you enjoying your recovery summer? That’s what the president said we were having. But that was last year,” Pawlenty said. “Gas is nearly $4 a gallon. Home prices are in the gutter. Our healthcare system – thanks to ‘Obamacare’ – is more expensive and less efficient. Unemployment’s back over 9%. Our national debt has skyrocketed. Our budget deficit has grown worse. And the jobs and manufacturing reports are grim.

[….]

Later, Pawlenty told reporters if economic growth fell from his target of 5% to “4, 3, 2 or 1%, then we’re in deep doo-doo. We are in deep crap.”

Pawlenty proposed cutting the federal corporate tax rate from 35% to 15%, coupled with closing loopholes. For individuals, Pawlenty said he was proposing a “simpler, fairer, flatter” tax system. Those who currently don’t pay income taxes wouldn’t be affected. But he would impose a 10% tax rate on the first $50,000 of individual income and on joint income up to $100,000. Income above those levels would be taxed at 25%, well below the current maximums.

To me, Economics seems to contain a lot of smoke and mirrors.

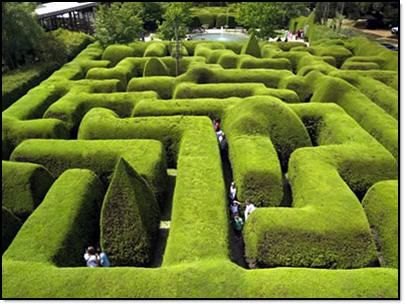

In my ignorance, I fail to see a way out of this maze. Corporations don’t seem to be inclined to start spending on expansion, because they see weak demand for the foreseeable future. How, then, would cutting the corporate tax rate to 15%, as Pawlenty wants to do, do any good?

Further stimulus in the form of increased government spending seems to be off the table. The State Governments are cash-strapped, and the Republicans who control the U.S. House of Representative and who have filibuster power in the Senate will simply not let the Federal Budget increase. The Teabaggers simply won’t let them, because it would be deficit spending, and the R. incumbents are petrified of the Teabaggers and primary challenges.

So, what’s left? A massive shift in what the Federal Government already spends? I don’t see how the vested interests will allow that to happen. Just look at the influence they wielded over Health Insurance Reform.

If we ended the war in Afghanistan, and closed many of our military bases overseas, brought most of the troops home, stopped building new weapons systems, and devoted the manufacturing base (such as it still exists) to, e.g., solar cells, wind turbines, high-speed rail for passengers and freight… in other words, embarked on a huge infrastructure rebuilding and conversion program, surely that would help put people back to work.

But how could the President ever get the Congress to go along? And what of, e.g., the long-distance truckers who would be put out of work if most of the freight were moved over to rail? And what of the oil interests, and the people who own and work in the fuel stations and restaurants and motels along the Interstate Highways, etc., etc.?

Tim Pawlenty says that gas is at $4 per gallon and housing prices are in the gutter. Both of those things are true, but what can be done about either of them?

Drill, baby, drill! Drill here and drill now! won’t make an appreciable difference in oil prices. Even if it did, and putting aside the environmental consequences, lower oil prices would just postpone the day of reckoning… the day when we are going to have to switch to some other source of energy.

And housing… how can housing prices rise with unemployment being what it is, and with so many houses on the market? There are only so many buyers, and only so much cash.

I recently checked the Zillow.com web site for the estimated market value of the home that I and my wife purchased five years ago. According to Zillow, it’s now worth 25% less than we paid for it.

I’ve seen stories about whole neighborhoods in the exurbs of Southern California and in Florida, Nevada, etc. that are virtual ghost towns.

If price is based on supply and demand, and there is:

(a) such weak demand; and

(b) such an overabundance of supply,

how can prices rise? And does it really help the bigger picture to have home prices rise again toward bubble levels? They were too high back then. People could not afford them, which is part of the reason why we got all of those no-doc and liar loans.

What got the United States out of the Great Depression was World War II… the war production that was paid for via Liberty Bonds, etc. No one wants to see another world war…. at least no one in his or her right mind.

But short of a massive productive effort devoted to the moral equivalent of war, and on a similar scale, how will things ever turn around? Cold Fusion and atomic energy too cheap to meter do not seem to be in the cards, so cheaper energy will not be freeing up cash for other purposes.

Scratching my head, and appreciative of guidance…

3 comments