Hope everyone the other side of the pond is slowly recovering from Turkey Torpor. Meanwhile, in Ireland, 100,000 took to the cold Dublin streets to protest against the ECB/IMF cuts being imposed to bailout the Irish Banks.

Don’t know about the US, but the dangers of another round of defaults and property price collapse is imminent in the Emerald Isle; check out Morgan Kelly’s worrying analysis

Money quote below the fold…

Banks have been relying on two dams to block the torrent of defaults – house prices and social stigma – but both have started to crumble alarmingly.

People are going to extraordinary lengths – not paying other bills and borrowing heavily from their parents – to meet mortgage repayments, both out of fear of losing their homes and to avoid the stigma of admitting that they are broke. In a society like ours, where a person’s moral worth is judged – by themselves as much as by others – by the car they drive and the house they own, the idea of admitting that you cannot afford your mortgage is unspeakably shameful.

That will change. The perception growing among borrowers is that while they played by the rules, the banks certainly did not, cynically persuading them into mortgages that they had no hope of affording. Facing a choice between obligations to the banks and to their families – mortgage or food – growing numbers are choosing the latter.

In the last year, America has seen a rising number of “strategic defaults”. People choose to stop repaying their mortgages, realising they can live rent-free in their house for several years before eviction, and then rent a better house for less than the interest on their current mortgage. The prospect of being sued by banks is not credible – the State of Florida allows banks full recourse to the assets of delinquent borrowers just like here, but it has the highest default rate in the US – because there is no point pursuing someone who has no assets.

If one family defaults on its mortgage, they are pariahs: if 200,000 default they are a powerful political constituency. There is no shame in admitting that you too were mauled by the Celtic Tiger after being conned into taking out an unaffordable mortgage, when everyone around you is admitting the same.

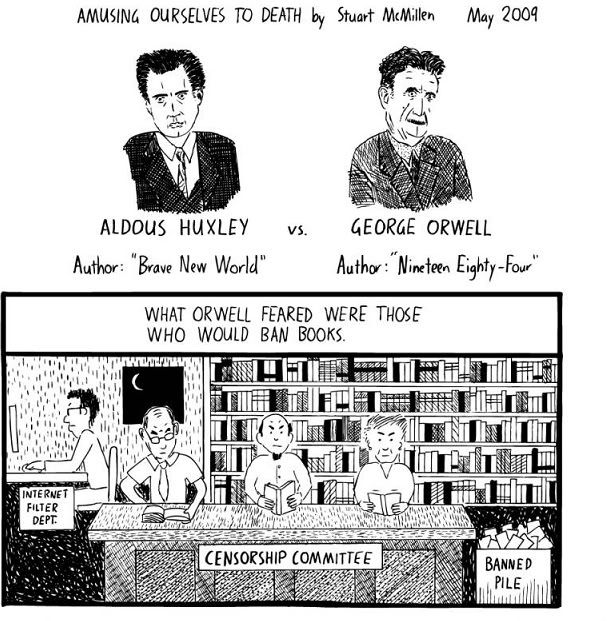

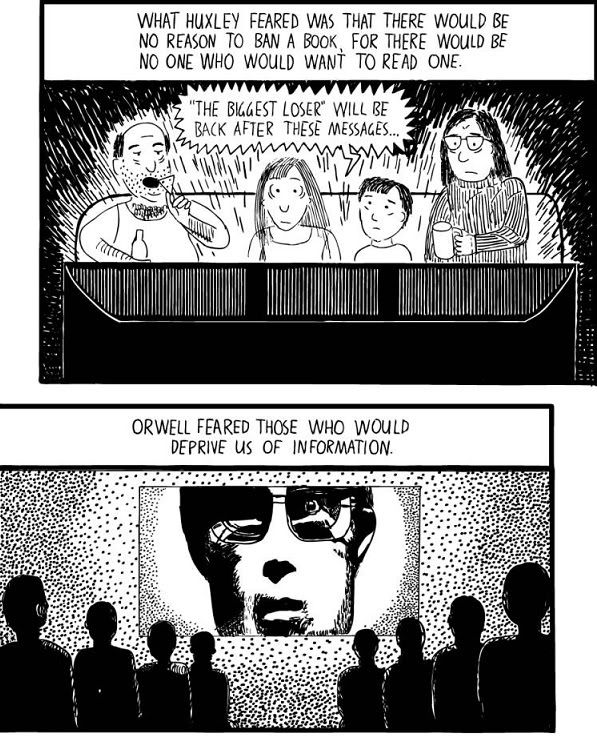

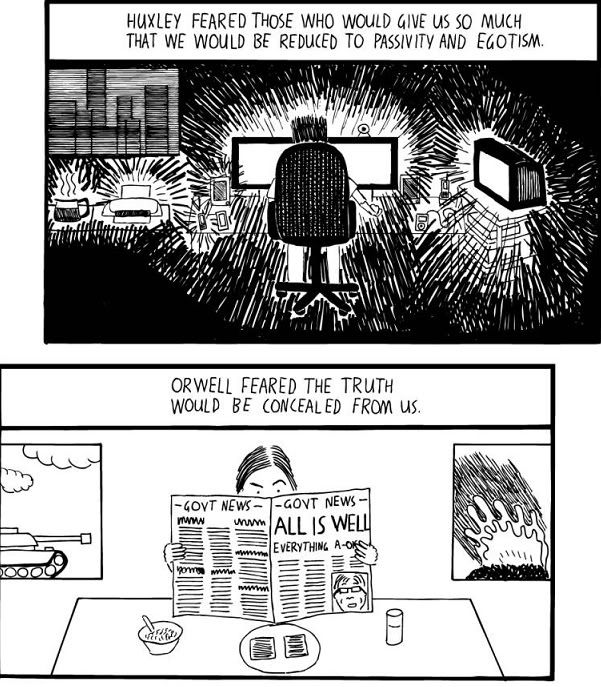

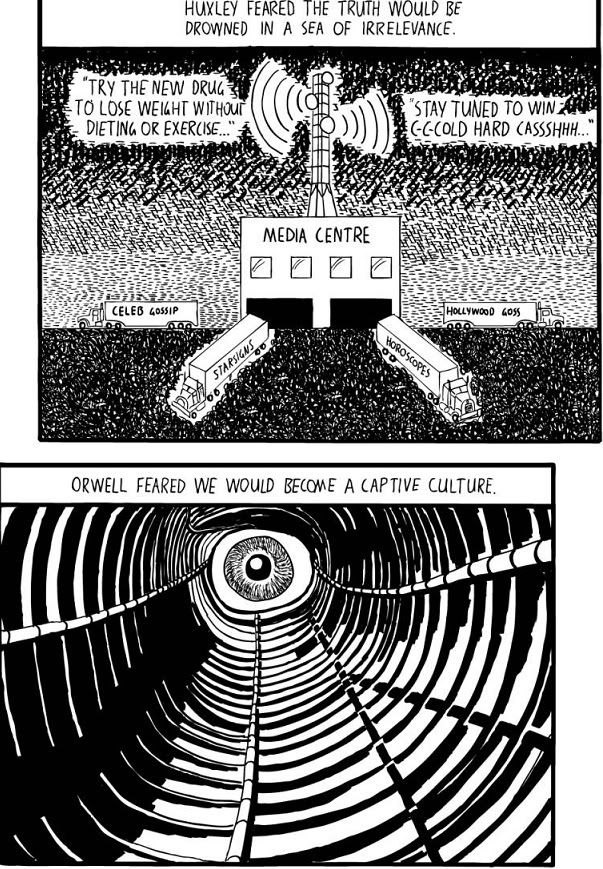

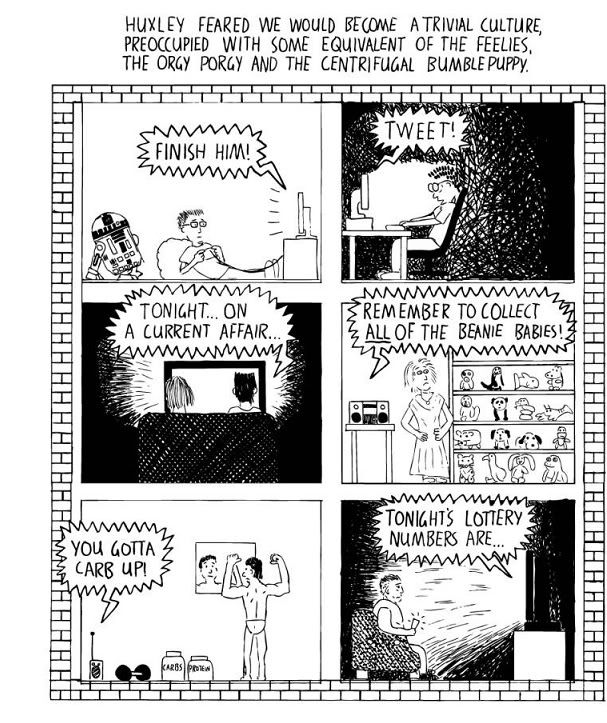

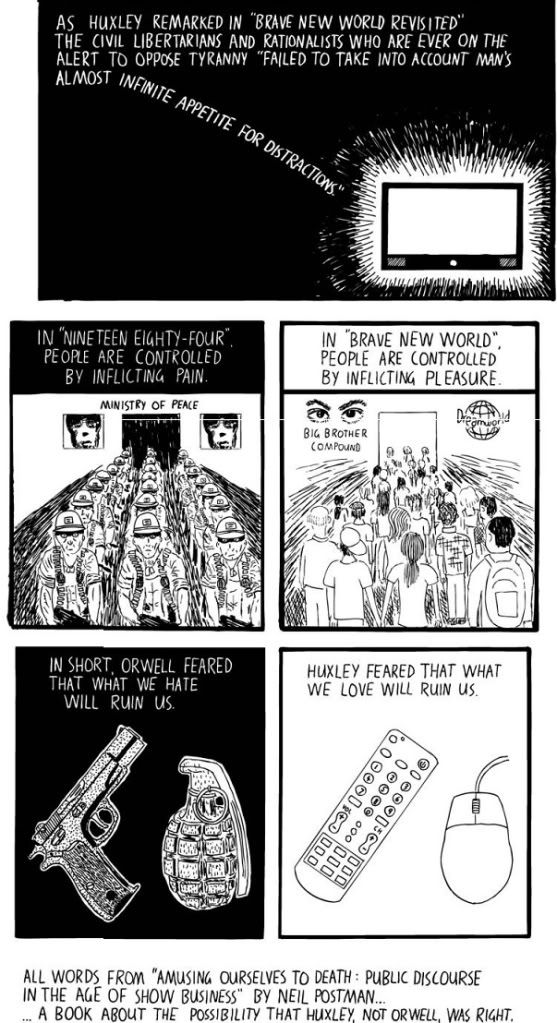

Meanwhile, hat tip to Andrew Sullivan’s blog for a wonderful graphic that summarises Neil Postgate’s chilling book Amusing Ourselves to Death where he compares the two dystopias projected over 50 years ago by Orwell in 1984 and Aldous Huxley in Brave New World.

No prizes for guessing who turned out to be the most prophetic

15 comments