For weeks there has been an emerging story which casts doubt on the validity and provenance of documents used in foreclosure proceedings nationwide:

It is a legal impossibility for someone without a mortgage to be foreclosed upon. It is a legal impossibility for the wrong house to be foreclosed upon, it is a legal impossibility for the wrong bank to sue for foreclosure.And yet, all of those things have occurred. The only way these errors could have occurred is if several people involved in the process committed criminal fraud. This is not a case of “Well, something slipped through the cracks.” In order for the process to fail, many people along the chain must commit fraud.

Barry Ritholtz – Why Foreclosure Fraud Is So Dangerous to Property Rights The Big Picture 12 Oct 10

The use of the Mortgage Electronic Registration System by the majority of lenders, especially for mortgages securitised and resold to investors, inadequate or concocted documents and imperfect ‘due process’ by unqualified loan officers has created uncertainty regarding the status of mortgage-holders and their standing as plaintiffs at foreclosure:

“If people say that you cannot prove that you own the loan, it could be really cumbersome to untangle,” said [Jeffrey Gundlach, chief executive officer of DoubleLine Capital LP], whose firm manages $5.5 billion in investments, mostly mortgage-backed securities. “It has the potential to spiral into much, much more. There have been many twists and turns to the foreclosure process since the credit crisis started and this is one more turn of the wheel, and it can spin out of control.”John Gittelsohn – Securitization Flaws May Lead Investors to Fight Mortgage Deals Bloomberg 14 Oct 10

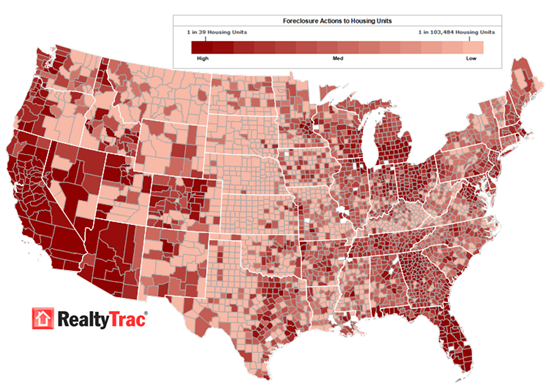

In spite of the volume of foreclosure actions, 100,000 in the past month alone, the crisis emerging as securitised mortgage documentation is presented in court has led major institutions to declare a self-imposed moratorium on foreclosures, at least for properties ‘held’ by MERS.

There is more to the problem, however. The process by which these mortgages were originally transferred to trusts for sale to institutional purchasers is questionable and may be found to be defective, rendering them essentially worthless and exposing the banks who sold them to liability at par with their original value, roughly $1.4 trillion dollars.

It is a tangled web. In the good old days when you secured a mortgage the title was registered at the local County Clerk’s office and due diligence was performed by your conveyancing attorney and the lender:

Every step of the process is designed to protect the property rights of all parties. The result is more than a mere transaction selling property from one party to another; rather, this has created a system where ownership interests are clearly defined; where title history can be reviewed going back decades and centuries. There is a certainty to the purchasers of this property against all future claims.Barry Ritholtz – Why Foreclosure Fraud Is So Dangerous to Property Rights The Big Picture 12 Oct 10

This laborious process represented an excessive overhead when banks started packaging mortgages so the MERS solution was used increasingly as the mortgage market prospered, a national on-line registry of mortgages funded and operated exclusively by and for financial institutions handling large volumes of mortgage debt transactions. In fact MERS is considered by the financial industry to be the ‘mortgagee’ in over sixty-million mortgages. But it may be inherently flawed:

…the language used by MERS in its registry at local courthouses is contradictory (it claims to be both the owner of the mortgage and as well as a nominee; legally, a single party can’t play two roles simultaneously), rendering it unenforcable; MERS has employees of servicers and law firms become “MERS vice presidents” or secretaries when fit none of the criteria that fit those roles, and also have clear conflicts of interest given that they are also full time employees of other organizations; MERS record keeping has the hallmarks of being poorly controlled (there have been cases of mortgages basically being stolen from other MERS members; some contacts have suggested that a single MERS member can assign a mortgage, meaning checks are weak; MERS members are not required to update records). And most important, every state supreme court that has looked at the role of MERS has ruled against it.Yves Smith – The Wheels Are Coming Off in MBS Land Naked Capitalism 13 Oct 10

Recent rulings have questioned the use of MERS as ‘mortgagee’ and their standing at foreclosure. Subsequently J P Morgan, among others, have unilaterally suspended foreclosure actions which cite MERS as plaintiff:

Even though the headline item is the fact that the attorneys general in all 50 states are joining the mortgage fraud investigation, the real indicator that the banks are stressed is that they have started abandoning MERS, the electronic database that passes itself off as a registry for mortgages. JP Morgan has quit using it as an agent on foreclosures; it clearly can’t withdraw from it fully, given that it has become a central information service.Despite this being treated as a pretty routine event in the JP Morgan earnings call, trust me, it isn’t. The withdrawal of JP Morgan from the use of MERS as the face in foreclosures is a tacit admission that the past practice of using MERS as the stand-in for the trust is problematic. I’ve heard lawyers discuss the possibility of class action litigation to invalidate all MERS-initiated foreclosures in states with strong anti-MERS rulings; this idea no doubt will get more traction given JP Morgan’s move.

Yves Smith – The Wheels Are Coming Off in MBS Land Naked Capitalism 13 Oct 10

The ramifications of this are considerable and potentially affect homeowners, whether in default or not, and purchasers nationwide:

One judge, the honorable Jon Gordon of Florida’s circuit court in Miami-Dade stated that: “It truly concerns me, however, that thousands and thousands – thousands and thousands of mortgage foreclosure actions have been filed with these allegations. I am not certain what remedy, if any, these people would have were it to be determined that MERS was not ever the proper party notwithstanding that these folks [might] have been in default what their recourse, if any, would be. I’m not certain with the satisfaction of mortgages that have been filed on behalf of MERS how good those are and I am not certain how good title to property is that people bought at these foreclosure sales if it turns or becomes established that MERS was indeed not only not the right party but misrepresented by way of their pleadings and affidavits that they held something they didn’t own, so I’m not certain of the consequences but it seems vast.”MERS Wikipedia

But the validity of MERS’ pleadings as litigant in foreclosure proceedings is just the pointy end of the problem. The legal process by which these mortgage based securities were created is under review and there is some evidence that it is deficient as well:

Nearly all Pooling and Servicing Agreements require that “On the Closing Date, the Purchaser will assign to the Trustee pursuant to the Pooling and Servicing Agreement all of its right, title and interest in and to the Mortgage Loans and its rights under this Agreement (to the extent set forth in Section 15), and the Trustee shall succeed to such right, title and interest in and to the Mortgage Loans and the Purchaser’s rights under this Agreement (to the extent set forth in Section 15)”. Also, an Assignment of Mortgage must accompany each note and this almost never happen[ed].We believe nearly every single loan transferred was transferred to the Trust in “blank” name. That is to say the actual loans were apparently not, as of either the cut-off or closing dates, assigned to the Trust as required by the PSA.

Rather than continue to fight for the “put-back” of individual loans the investors may be able to sue for and argue that the “true sale” was never achieved. To think of it simply, if you go to sell your car and you endorse your title but neither you nor the party you are selling it to sign their name who owns the car? It appears you likely still do.

Josh Rosner via Yves Smith – Josh Rosner: “Could Violations of PSA’s Dwarf Lehman Weekend?” Naked Capitalism 12 Oct 10

Essentially the investors, your mutual fund or a foreign government, whom purchased these toxic assets for real money back in 2007, might have a case for suing the banks to buy back these faulty instruments at par value, their original price. And the banks certainly don’t have that kind of money.

Furthermore, your mortgage, if the note is still technically held by the original lender, which appears to be the case, may be in the hands of an institution which vapourised in 2008. This level of uncertaintly is clearly not what we want to face while desperately trying to restore the housing market to liquidity and it could take a long time to sink in and more to unravel. We are only a quarter of the way through the number of predicted foreclosures.

The inside scoop, anecdotaly:

One of my colleagues had a long conversation with the CEO of a major subprime lender that was later acquired by a larger bank that was a major residential mortgage player. This buddy went through his explanation of why he thought mortgage trusts were in trouble if more people wised up to how they had messed up with making sure they got the note. The former CEO was initially resistant, arguing that they had gotten opinions from top law firms. My contact was very familiar with those opinions, and told him how qualified they were, and did not cover the little problem of not complying with the terms of the pooling and servicing agreement. He also rebutted other objections of the CEO. The guy then laughed nervously and said, “Well, if you’re right, we’re fucked. We never transferred the paper. No one in the industry transferred the paper.”Yves Smith – FUBAR Mortgage Behavior: Florida Banks Destroyed Notes; Others Never Transferred Them Naked Capitalism 27 Sep 10

Stay tuned. Some analysts are suggesting we have another heart-sinking economic moment ahead of us as the financial industry comes to terms with these issues:

The investors who hold that MBS might be able to claim that the bonds they hold were not created properly, contracts were breached, and the bank that originated the mortgages needs to buy back the bonds. This, of course, would require many billions of dollars in capital in excess of that banks have lying around. And remember these aren’t pretty bonds. They are mostly toxic and full of losses. Those losses would then be passed on to the banks.[Josh Rosner] imagines this leading to a Lehman-type weekend, where the financial industry again nears collapse. That might be a little melodramatic, but it isn’t impossible. If these investors have the legal standing that Rosner thinks, they would be sort of crazy not to force banks to take back these bad deals.

Daniel Indiviglio – Foreclosure-Gate’s Doomsday Scenario The Atlantic 13 Oct 10

And the mere hint of something like this is not going to play well on Wall Street. We may get another opportunity to nationalise the banks yet.

Cross-posted at Daily Kos

53 comments