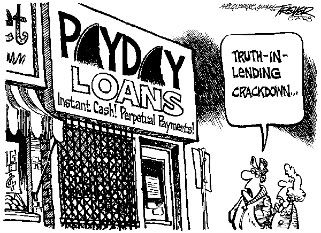

I think now is as good a time as any to remind ourselves that taking advantage of poor people is definitely a bi-partisan past time here in the United States.

Payday loans, for those of you unfamiliar with the practice, are small, very short-term loans with extremely high interest rates (sometimes in the range of 400-800%) that are effectively advances on a borrower’s next paycheck. They’re typically obtained when a borrower goes to a check-cashing outlet or an online equivalent, pays a fee, and then writes a postdated check, or signs over the title to a vehicle, that the company agrees not to cash or take a lien against until the customer’s payday.

Thank God we’ve got Congressmen willing to stand up for working Americans against these sorts of shenanigans, right?

… right?

From the AP comes the “good works” of one Congressman Luis Gutierrez (D-IL):

Indeed, the payday lending industry is strenuously resisting Gutierrez’s measure, which it says would devastate its business. The measure would cap the annual interest rate for a payday loan at 391 percent, ban so-called “rollovers” – where a borrower who can’t afford to pay off the loan essentially renews it and pays large fees – and prevent lenders from suing borrowers or docking their wages to collect the debt.

My God! Cap the annual interest rate at 391 percent Noooooo! Don’t you know these lenders have BMWs, vacation homes, and yachts to pay off? Please, won’t somebody think of the lenders? No wonder they are “strenuously resisting” this legislation!

Thank God for Congressman Gutierrez, though, for thinking to limit the APR at a measly 391%. Though, in deference to Congressman Gutierrez, it appears he’s losing in a pissing contest to see who can bend over the farthest for the Payday Loan industry with Congressman Joe Baca (D-CA).

Baca on Wednesday introduced his own version of payday lending legislation that has gotten a warmer reception from the industry. It would allow some rollovers and pre-empt state laws, which would effectively pave the way for payday lending in states whose laws currently make it difficult or impossible. And it allows online lenders to charge higher fees than their bricks-and-mortar brethren.

Yeah, that’s right, let’s just override laws on the books of dozens of states outlawing payday loans; hell, why not, right? And let’s let online lenders- you know, the ones not actually investing any money into infrastructure, hiring employees, paying for utilities and actually contributing at least something back to the community- charge even more in fees.

Really, how far removed from real life are these people? Look, I understand- you’ve got to have a profit to stay in business. It costs money to make money, et cetera. But if I took out a cash advance on my credit card, I’d pay, what- 25%? And I’ve been in situations where I’ve had to seriously consider using payday loans to put food on the table for my 15-month old and I. My hours at work have been cut back significantly due to the downturn in our business from the sagging economy, and, like many of us, I’m just barely keeping my head above water. So I’m flabbergasted in wondering how people can live in a bubble like this- no matter their political affiliations, this is un-freaking-believable.

Drop a line to Congressmen Luis Gutierrez and Joe Baca and let them know how you feel:

Contact Information for Congressman Luis Gutierrez

Contact Information for Congressman Joe Baca

7 comments